- Deposits

- Withdrawals

- Exness Payment Methods

- Base Currencies at Exness

- Making Deposits on Exness: A Comprehensive Guide

- Withdrawing Funds from Exness: Efficient and Flexible Options

- Exness Transaction Security Measures: Ensuring Safe and Secure Trading

- Ensuring Smooth and Secure Transactions at Exness: Essential Tips

- Exness Payments FAQs

Exness provides a straightforward and secure platform for handling deposits and withdrawals, ensuring that traders can efficiently access their funds and participate in market activities. Below is an overview of the processes for depositing and withdrawing funds at Exness, including the payment methods and available base currencies.

Deposits

- Ease and Speed: Exness offers instant deposit options for many payment methods, allowing traders to quickly take advantage of trading opportunities without delay.

- Security: All financial transactions are protected with advanced encryption technologies, ensuring the safety of your financial data and the security of your funds.

Withdrawals

- Fast Processing: Exness is known for its rapid withdrawal processing times, with many transactions either being instant or completed within 24 hours, depending on the payment method used.

- Minimal Charges: Exness strives to keep withdrawal charges low. Although Exness itself typically does not impose fees, external charges from payment service providers may apply under certain circumstances.

- Limits: Generally, there are no set maximum withdrawal limits at Exness, although limits may be affected by the payment method’s restrictions or the available balance in your account.

- Withdrawal Period: The time it takes to process withdrawals can vary. While many are immediate, others might take from a few hours to several business days, depending on the payment method.

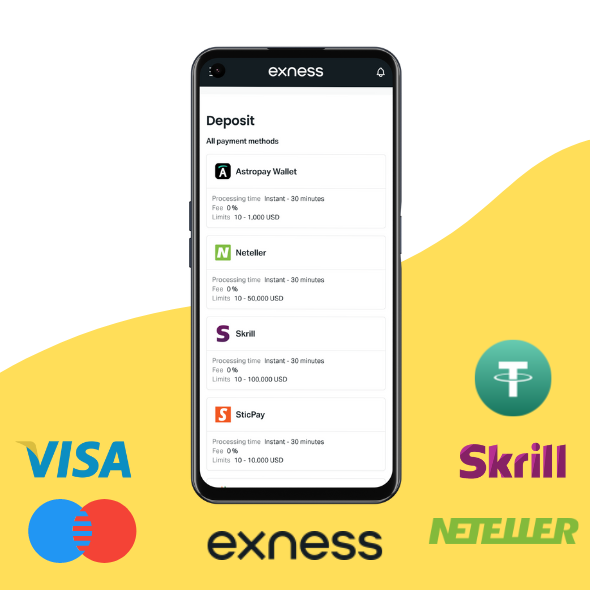

Exness Payment Methods

Exness accommodates a wide array of payment methods to serve its diverse global clientele, providing various options for depositing and withdrawing funds:

- Bank Wire Transfers: Best suited for large transactions, although processing times can vary depending on the bank.

- Credit/Debit Cards: Supports major cards like Visa and MasterCard, which allow for instant deposits and quick withdrawals.

- E-Wallets: Includes popular options like Neteller, Skrill, and WebMoney, known for their quick processing times.

- Cryptocurrencies: Accepts major cryptocurrencies like Bitcoin, offering a modern, secure, and cost-effective way to transact.

Base Currencies at Exness

To accommodate its international users, Exness provides a selection of base currencies, reducing the need for currency conversion and associated costs:

- USD (United States Dollar)

- EUR (Euro)

- GBP (British Pound)

- JPY (Japanese Yen)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

- CHF (Swiss Franc)

- NZD (New Zealand Dollar)

This variety allows traders to manage their accounts and engage in trading using the most economical and practical currency options, potentially minimizing exposure to exchange rate fluctuations.

Exness streamlines the deposit and withdrawal process with a focus on quick execution, minimal fees, and strong security protocols. Whether you’re just starting in trading or are a seasoned professional, Exness provides extensive support to ensure you can manage your trading finances efficiently and securely.

Making Deposits on Exness: A Comprehensive Guide

Depositing funds into your Exness trading account is streamlined to ensure traders can manage their finances effectively. Here’s an in-depth guide on how to make deposits, along with insights into associated limits, fees, potential issues, and bonuses.

Exness Deposit Limits and Associated Fees

Deposit Limits:

- Minimum Deposit: This varies by account type and deposit method. For example, Standard Accounts often have no minimum requirement, whereas Pro Accounts may require a higher initial deposit.

- Maximum Deposit: Exness does not typically set maximum deposit limits, but your chosen payment processor’s limits may apply.

Associated Fees:

- Deposit Fees: Exness generally does not charge fees for deposits, but fees may be incurred from payment processors or banks, particularly if currency conversion is involved.

- Currency Conversion: If you deposit in a currency different from your account’s base currency, a conversion fee may apply, which is important to consider when selecting your account’s base currency.

Problems and Solutions for Exness Deposits

Common Deposit Issues:

- Transaction Not Processed: This can occur due to incorrect payment details or insufficient funds.

- Delayed Transactions: Most deposits are instant; however, methods like bank transfers may take longer, which could delay your trading.

Solutions:

- Verification of Details: Double-check all payment details before making a deposit.

- Consult Payment Provider: For delays, consult your payment provider to identify any issues on their end.

- Contact Exness Support: If a deposit does not reflect in your account within the expected timeframe, contacting Exness customer support can help resolve the issue promptly.

Exness Deposit Bonus

Availability of Deposit Bonuses:

- Promotional Offers: Exness sometimes offers deposit bonuses as part of promotional campaigns, which provide additional trading credit based on the amount deposited.

- Terms and Conditions: Each bonus comes with specific terms, including minimum deposit amounts and eligibility criteria. It’s crucial to understand these terms to fully benefit from any bonuses.

Benefits of Deposit Bonuses:

- Increased Trading Volume: Bonuses can significantly enhance your trading capacity, allowing for larger or more frequent trades.

- Risk Management: Additional funds can provide more flexibility in how you manage your trades, helping to diversify trading risks.

The deposit process at Exness is designed to be efficient and user-friendly, supporting a variety of payment methods and currencies to accommodate traders worldwide. While the system aims to minimize issues, being proactive in managing common problems can enhance your trading experience. Additionally, leveraging promotional deposit bonuses when available can substantially boost your trading strategy and capital efficiency, ensuring you fully understand the terms associated with these bonuses to maximize your trading potential.

Withdrawing Funds from Exness: Efficient and Flexible Options

Withdrawing funds from your Exness account is straightforward and flexible, designed to meet the needs of global traders. Here’s a detailed look at how to effectively withdraw funds, particularly using Skrill, along with an overview of general withdrawal times at Exness.

Skrill Withdrawals at Exness:

How to Withdraw Using Skrill:

- Log into Your Personal Area: Start by accessing your Exness Personal Area with your login details.

- Select ‘Withdraw’: Navigate to the ‘Withdrawal’ section and choose Skrill from the available methods.

- Enter Withdrawal Details: Specify the amount you wish to withdraw and confirm the email linked to your Skrill account is correct.

- Confirm the Transaction: Follow the prompts to confirm the withdrawal, which may include a verification step via email or phone for added security.

Advantages of Using Skrill:

- Speed: Withdrawals through Skrill are typically processed instantly once approved, making funds available in your Skrill account within minutes.

- Low Fees: Skrill is noted for its low transaction fees, which makes it a cost-effective option for traders.

- Ease of Use: Skrill’s user-friendly interface makes it easy to carry out transactions swiftly and without hassle.

General Withdrawal Times at Exness:

- Instant Withdrawals: Many methods, like e-wallets including Skrill, offer instant processing, allowing transactions to complete within minutes.

- Bank Transfers and Credit Cards: Withdrawals through these methods typically take longer, ranging from a few hours to several business days, influenced by factors like bank processing times.

Factors Affecting Withdrawal Times:

- Verification Status: Accounts that are fully verified usually experience smoother and quicker withdrawals.

- Withdrawal Amount: Larger withdrawals may be subject to additional security reviews, extending processing times.

- Payment Service Providers: The efficiency of the involved bank or payment service can also affect the speed of withdrawals.

Tips for Efficient Withdrawals:

- Verify Your Account Early: Complete all necessary KYC procedures well before your first withdrawal to ensure smooth processing.

- Follow Withdrawal Limits: Adhere to the limits set by Exness and your chosen payment method to avoid complications.

- Regularly Update Payment Details: Keeping your payment method details up-to-date can help avoid delays or rejections of your withdrawal requests.

Using Skrill for withdrawals from Exness combines speed, convenience, and security, making it a favored choice among traders. Understanding typical withdrawal times and factors that influence these times enables traders to manage their financial transactions more effectively, ensuring timely access to their funds when needed. This comprehensive approach to managing withdrawals enhances the trading experience by allowing traders to focus more on their strategies and less on administrative concerns.

Exness Withdrawals: Navigating Limits, Fees, and Common Challenges

Exness aims to provide a straightforward and transparent withdrawal process for traders. This guide details withdrawal limits, associated fees, and common issues, along with practical solutions to ensure a smooth transaction experience.

Withdrawal Limits

- Minimum and Maximum Limits: These limits vary by payment method. E-wallets like Skrill typically have lower minimum withdrawal limits compared to bank transfers. Maximum limits may depend on the trader’s account type and available balance.

- Daily and Monthly Limits: Some payment methods may impose daily or monthly withdrawal limits. These limits are usually set by the payment processors and not Exness, so it’s important to verify the details with both Exness and your payment service provider.

Fees

- Exness Fees: Exness does not charge fees for withdrawals, but other fees may apply.

- Third-Party Fees: Fees may be imposed by banks, credit card issuers, and e-wallet providers such as Skrill. These fees can vary and should be verified directly with the provider.

- Currency Conversion Fees: If you withdraw funds in a different currency from your account’s base currency, you may incur a conversion fee, dependent on the current exchange rates and policies of the payment service provider.

Common Withdrawal Issues and Solutions

- Delayed Withdrawals: Withdrawals generally process quickly; however, methods like bank transfers can face delays due to processing times required by banks.

- Withdrawal Rejections: Errors such as incorrect payment details or non-compliance with anti-money laundering regulations can lead to withdrawal rejections.

- Verification Issues: Incomplete account verification or additional verification needed for large withdrawals can delay or block transactions.

Solutions:

- Check Account Status: Ensure your account is fully verified with all required documents, including identity, address, and payment method verifications.

- Review Payment Details: Confirm the accuracy of all payment details and maintain consistency between your deposit and withdrawal methods.

- Contact Support: If you encounter unresolved issues or delays, Exness customer support can provide detailed assistance.

- Be Aware of Service Hours: Account for non-working days or bank holidays, which can affect processing times, especially for withdrawals requiring manual handling.

Tips for Smooth Withdrawals

- Preemptive Verification: Complete all necessary verifications early to avoid delays when you decide to withdraw funds.

- Consistent Payment Methods: Use the same method for both deposits and withdrawals whenever possible to facilitate smoother transactions and comply with regulatory requirements.

- Stay Informed: Regularly check for any updates from Exness and your payment provider regarding changes in withdrawal processes or fees.

- Plan for Delays: Anticipate potential delays, particularly with slower withdrawal methods like bank transfers.

By understanding and preparing for these aspects of the withdrawal process, traders can effectively manage their withdrawals at Exness, ensuring they can access their funds with minimal inconvenience and maximum security.

Exness Transaction Security Measures: Ensuring Safe and Secure Trading

Exness prioritizes transaction security, implementing robust measures to protect clients’ funds and personal information.

- Advanced Encryption Technology: Exness uses SSL (Secure Socket Layer) encryption to secure all data transmissions, protecting personal information and transaction details from unauthorized access.

- Two-factor Authentication (2FA): This security measure adds a layer of protection by requiring both a password and a second factor, such as a code sent via SMS or a notification on a recognized device, safeguarding against unauthorized account access.

- Compliance with Financial Regulations: Exness adheres to strict international financial regulations, ensuring all transactions are monitored and maintained within legal and ethical standards.

- Regular Security Audits: Proactive internal and external audits are conducted to identify and address potential vulnerabilities, enhancing transaction security.

- Secure Payment Gateways: Exness partners with reputable payment providers to ensure that financial transactions are processed through secure and reliable gateways.

These security practices are crucial in maintaining the integrity of every transaction and providing a safe trading environment for all Exness users.

Ensuring Smooth and Secure Transactions at Exness: Essential Tips

To optimize security and efficiency when trading with Exness, follow these essential tips:

Security Best Practices

- Keep Your Software Updated: Regularly update your trading platform, web browser, antivirus software, and any other related applications to safeguard against security vulnerabilities.

- Use Secure Networks: Avoid public Wi-Fi networks for trading activities. Instead, utilize a secure, private, and encrypted internet connection to protect your account details and financial transactions.

- Regularly Monitor Account Activity: Keep a vigilant eye on your account transactions and regularly review statements to catch any unauthorized or suspicious activities early. Report any unusual findings immediately to Exness customer service.

- Implement Strong Passwords: Use complex and unique passwords for your Exness account and change them periodically. Consider employing a password manager to help maintain strong password security.

- Be Wary of Phishing Attempts: Exercise caution with any emails or messages that request your account details or personal information. Always verify the legitimacy of such requests by contacting Exness directly through official channels.

Exness Payments FAQs

What payment methods are available at Exness?

Exness offers various payment options including bank wire transfers, credit/debit cards (Visa, MasterCard), e-wallets (Skrill, Neteller, WebMoney), and cryptocurrencies. The availability of these methods can vary by country.