Starting your trading journey with Exness means understanding key financial components, such as minimum deposit requirements. This guide clarifies these requirements to help newcomers confidently begin their trading pursuits.

Exness Minimum Deposit Framework

Exness tailors its minimum deposit requirements based on the type of account and the trader’s geographical location. This flexible approach is designed to accommodate both novice and experienced traders, allowing them to begin trading in a way that matches their financial capabilities and investment goals.

Standard Accounts:

For beginners, the Standard account is an ideal choice due to its low minimum deposit requirement, which can be as little as $1 depending on the region. This low barrier to entry makes it feasible for new traders to start trading without significant financial strain, facilitating an easier introduction to the financial markets.

Professional Accounts:

For more seasoned traders looking for advanced trading features, Exness offers accounts such as Raw Spread, Zero, and Pro, which typically require a minimum deposit of $200. These accounts feature enhanced trading conditions like tighter spreads, which are crucial for traders engaging in high-volume, high-frequency trading strategies. The availability of these accounts reflects Exness’s commitment to supporting serious trading professionals by providing the necessary tools and conditions to maximize their trading performance.

This structured deposit framework ensures that each trader can find an account type that aligns with their trading style and financial situation, making Exness a versatile choice for traders at all levels.

Exness Deposit Rates and Conditions

Exness is recognized for its competitive deposit conditions, which are strategically designed to optimize the investment efficiency of traders. Here are some key features of Exness’s deposit services:

Currency Conversion:

While Exness does not charge any fees for deposits, traders need to be aware of potential currency conversion charges. If a deposit is made in a currency different from the account’s base currency, the transaction will involve a conversion, typically at competitive rates. However, traders should remain vigilant about fluctuations in exchange rates which might affect the final amount credited to their trading account.

Instant Processing:

Most deposits at Exness, particularly those made through electronic payment methods or credit cards, are processed instantly. This immediate processing capability is crucial for traders who need to capitalize on fast-moving market opportunities and cannot afford delays in fund availability.

Transparency:

Exness is committed to transparency, ensuring that all traders are fully informed of any potential costs upfront. The platform clarifies that while it does not impose deposit fees, additional charges levied by payment service providers or banks may apply. This level of openness is aimed at avoiding any surprises that might affect the trading experience.

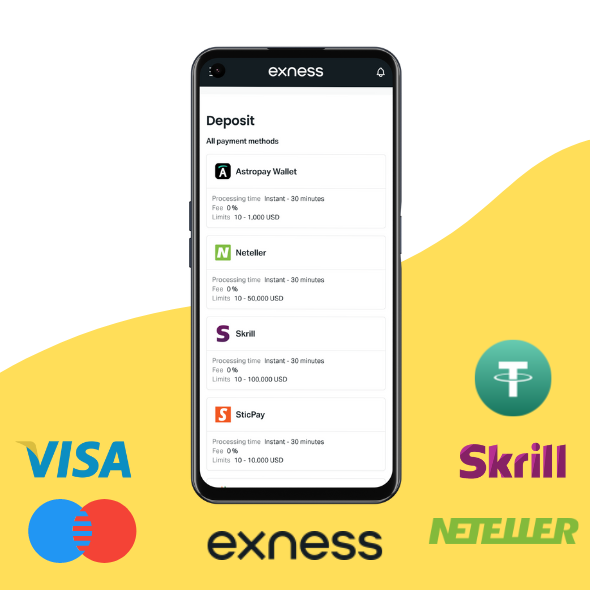

Diverse Payment Methods:

To cater to its global clientele, Exness supports a broad range of payment methods. These include bank transfers, credit/debit cards, and popular e-wallets such as Neteller, Skrill, and WebMoney. This diversity in payment options underscores Exness’s intent to provide convenient, flexible, and accessible deposit solutions for traders around the world.

By offering such a comprehensive and trader-friendly deposit framework, Exness not only facilitates ease of access to trading platforms but also enhances the overall trading experience by ensuring that traders can manage their funds effectively and efficiently. This commitment to facilitating user-friendly financial interactions makes Exness a preferred broker for traders seeking reliable and adaptable trading solutions.

Initiating Your Trading Journey with Exness

Getting started with Exness is streamlined and user-friendly, designed to assist you in launching your trading career with confidence. Here’s how you can begin your journey:

1. Account Registration

- Sign Up: Begin by visiting the Exness website where you can easily find the registration form. Fill it out with your personal details, such as your name, email address, and phone number.

- Verification: To comply with regulatory requirements and ensure the security of your account, you will need to complete the necessary verification procedures. This typically involves submitting copies of your identification documents, such as a passport or a driver’s license, and a utility bill or bank statement to verify your address. This step is crucial for ensuring the security and legality of your trading activities.

2. First Deposit

- Selecting the Deposit Amount: Depending on the account type you have chosen, you will need to make the required minimum deposit to activate your account. For Standard accounts, this could be as low as $1, while more professional account types like Raw Spread, Zero, and Pro may require a minimum of $200.

- Choosing a Payment Method: Exness offers a variety of deposit methods, including bank transfers, credit/debit cards, and e-wallets. Select the method that best suits your convenience and geographical location.

- Transaction Completion: Follow the instructions to complete your deposit. Remember, most deposits are processed instantly, so you can start trading almost immediately.

3. Begin Trading

- Accessing Trading Platforms: Once your account is funded, you can access Exness’s powerful trading platforms. Exness provides options like MetaTrader 4 and MetaTrader 5, renowned for their robust features and user-friendly interfaces.

- Exploring Market Opportunities: Start exploring the financial markets. Whether you’re interested in forex, commodities, indices, or cryptocurrencies, Exness offers a wide range of trading instruments.

- Leveraging Tools and Resources: Utilize the analytical tools, educational resources, and customer support provided by Exness to enhance your trading experience and increase your chances of success.

Ensuring a Smooth Start

- Educational Resources: Take advantage of the comprehensive educational materials Exness offers. These include tutorials, webinars, and articles that can help you understand market dynamics and develop effective trading strategies.

- Practice with a Demo Account: If you’re new to trading, using a demo account can be an invaluable step. This allows you to practice trading with virtual money, get accustomed to the trading platform, and test your trading strategies without any risk.

- Set Realistic Goals: Define your trading objectives clearly. Whether it’s building consistent profit over time or learning new trading strategies, having clear goals can help you measure your progress and stay motivated.

Long-term Engagement

- Stay Updated: Keep yourself informed about market conditions and financial news. Exness provides real-time market updates and analyses which can be critical for making informed trading decisions.

- Risk Management: Implement effective risk management strategies. This includes setting stop-loss orders to minimize potential losses and adjusting your trading volume according to the level of risk you are comfortable with.

By following these steps and utilizing the tools and resources offered by Exness, you are well on your way to becoming a successful trader. Exness’s commitment to providing a supportive and transparent trading environment makes it an excellent choice for traders at all levels, aiming for success in the global financial markets.

Deposit Methods and Fees at Exness: A Comprehensive Guide

Exness offers a diverse range of deposit methods designed to meet the needs of its global clientele, providing flexibility and ease of access. This guide details the available deposit methods at Exness and outlines the associated fee structure to help traders efficiently manage their funds.

Exness Deposit Methods

Exness has expanded its deposit options to cater to regional preferences and the latest in financial technology, ensuring there is a suitable choice for every trader:

- Local Bank Transfers: Available in many countries, local bank transfers reduce the need for currency conversion and can speed up the access to funds. This method is particularly useful for traders who prefer transactions with local banks for faster processing.

- Prepaid Cards: For those seeking additional privacy or who prefer not to use their bank accounts directly, Exness supports various prepaid card options, providing a secure and controlled way to deposit funds.

- Mobile Payments: With the increasing reliance on mobile technology, Exness accommodates mobile payment systems in certain regions, ideal for traders who handle their financial transactions on the go.

- Region-Specific Payment Systems: Exness integrates several payment systems specific to certain geographical areas, offering localized solutions that are convenient and accessible to traders in those regions.

- No Deposit Limits: Exness imposes no maximum deposit limit, catering to both high-volume traders and beginners. Minimum deposit requirements are very low, starting from just $1 for certain accounts, encouraging new traders to start with minimal financial commitment.

These methods are seamlessly integrated into the Exness trading platform, focusing on security, speed, and user convenience. The range of options ensures that traders worldwide can begin trading quickly and effectively, with the freedom to select the payment solution that best suits their needs.

Associated Fees with Depositing at Exness

Exness is committed to transparency and affordability, generally not charging internal fees for deposits. However, traders may encounter external costs:

- Third-Party Fees: Some payment processors or banks might impose their own fees, independent of Exness.

- Currency Conversion: If a deposit is made in a currency different from the account’s base currency, the payment processor may apply a conversion fee.

Additional Considerations

- Currency Conversions: Be aware of potential conversion fees if depositing in a currency different from your account’s base currency.

- Minimum Deposit Limits: These may vary based on the trader’s country of residence and the chosen payment method.

- Security Measures: Exness employs advanced security protocols to ensure the safety of all transactions. Additional verification might be required for certain deposit methods.

Getting Started with Deposits

To deposit funds:

- Log into Your Personal Area: Go to the ‘Deposit’ section.

- Select Your Preferred Method: Choose from the available deposit methods.

- Complete the Transaction: Follow the on-screen instructions to finalize the deposit.

Exness Deposit Commissions and Fees

Exness strives to facilitate accessible trading by not charging internal fees for deposits, though external fees from payment providers may apply:

- No Internal Fees: Exness does not charge fees for deposits.

- Third-Party Fees: Be aware of possible fees charged by banks or e-wallet providers, which can vary by provider.

- Currency Conversion Charges: These fees are determined by the payment processor based on current exchange rates and their policies.

Processing Time for Deposits

- Instant Processing: Most electronic payments are processed instantly, allowing traders immediate access to funds.

- Bank Wire Transfers: These may take several days, depending on the banks involved and their processing times.

- Cryptocurrency Deposits: Typically quick, although times can vary depending on the cryptocurrency network’s status.

By understanding these deposit methods and associated details, traders can effectively manage their Exness accounts, ensuring they are well-prepared to take advantage of market opportunities.

Navigating Account Currency Options at Exness

Exness offers a broad array of account currency options to accommodate the diverse needs of its global clientele. This flexibility allows traders to select a currency that they are most comfortable with or one that offers advantages based on their geographical location or trading strategy. Here’s an insightful overview of the available currency options for an Exness trading account:

Exness Account Currency Options

Traders can manage their accounts in a variety of currencies, which include but are not limited to:

- Major global currencies like the USD (United States Dollar), EUR (Euro), GBP (British Pound Sterling), and JPY (Japanese Yen).

- Commodity currencies such as the AUD (Australian Dollar), CAD (Canadian Dollar), and NZD (New Zealand Dollar).

- Emerging market currencies including the CNY (Chinese Yuan), RUB (Russian Ruble), and BRL (Brazilian Real).

- Cryptocurrencies like BTC (Bitcoin), ETH (Ethereum), and LTC (Litecoin) for those interested in modern digital transactions.

- Other currencies tailored to specific regional needs like the KWD (Kuwaiti Dinar), SAR (Saudi Riyal), and INR (Indian Rupee).

This extensive selection underscores Exness’s commitment to providing personalized trading experiences by allowing traders to manage their accounts in the currency that best suits their individual needs. Choosing the right account currency can help traders avoid conversion fees and streamline their financial management.

How to Deposit Money into Your Exness Account

Depositing funds into your Exness account is designed to be straightforward, enabling traders to quickly capitalize on trading opportunities. Follow these detailed steps to securely deposit funds:

- Log In to Your Account: Access your Exness Personal Area by logging in on the official Exness website with your credentials.

- Navigate to the Deposit Section: Find the ‘Deposit’ section, usually directly accessible from your dashboard or under a finance-related tab.

- Select Your Deposit Method: Choose from the available deposit methods, which include credit/debit cards, bank transfers, e-wallets, and cryptocurrencies.

- Enter Deposit Details: Specify the amount you wish to deposit and any necessary details. At this stage, review any applicable deposit limits or fees.

- Confirm Currency and Details: Make sure the deposit currency aligns with your account’s base currency to sidestep conversion fees. Double-check all details for accuracy.

- Complete Security Checks: If prompted, fulfill any additional security verifications like two-factor authentication or confirmations via linked email or mobile.

- Finalize the Deposit: Confirm all information is correct, then proceed to submit your deposit. You should see a confirmation on your screen, with possibly an email notification as well.

- Check Your Account Balance: Return to your dashboard to confirm that the funds have been added to your account balance. Updates are generally instant for electronic methods but may take longer for bank transfers.

Security of Your Deposited Funds with Exness

Exness employs robust security measures to ensure the safety of your transactions:

- Continuous Monitoring and Risk Management: Systems are in place to detect and prevent unauthorized access or fraudulent activities, with automatic alerts and protective actions.

- Two-Factor Authentication (2FA): Adds an extra layer of security, significantly reducing the risk of unauthorized account access.

- Data Privacy: Adherence to strict data protection laws and advanced encryption technologies protect client information.

- Customizable Security Settings: Allows clients to tailor security settings, including withdrawal confirmation codes and login alerts.

- Education and Awareness: Resources are provided to help clients recognize and protect against security threats.

- Dedicated Support Team: Specialized assistance is available for any security concerns, ensuring swift and effective resolutions.

By choosing Exness, traders can confidently manage their funds in a secure and tailored trading environment, equipped with a variety of currency options and reinforced by stringent security measures.

Frequently asked questions

Q: Does the deposit currency need to match my Exness account currency?

A: No, it does not need to match. If the deposit currency is different, Exness will convert the funds at competitive rates. Be aware of potential fluctuations in exchange rates.